EBI: Practice Smart Diversification

EVIDENCE BASED INVESTING: PRACTICE SMART DIVERSIFICATION

Many investors have a home bias to their own country, tending towards holding a portfolio of domestic stocks. For similar reasons (familiarity, knowledge, behavioural biases, levels of experience) it’s also common to see people gravitate towards brands they know and recognise when choosing stocks. Holding securities across many market segments can help manage overall risk but diversifying within your home market may not be enough. Global diversification is needed to broaden your investment universe.

Global Diversification

It is tempting to think that perhaps we could be sufficiently globally diversified by staying at home, safely investing in familiar global companies like HSBC. While that may be possible, particularly if the home market is large and diverse enough, this approach is still likely to be sub-optimal.

MODERN PORTFOLIO THEORY

Modern Portfolio Theory suggests that diversification – placing eggs in multiple baskets – can deliver a better relationship between the risk taken and the return received. On that basis, investors should consider spreading their equity eggs into baskets outside of their home market. In order to capture the wealth creation potential delivered by global capitalism, investors must own global capitalism in a far broader manner than is on offer by simply investing in FTSE companies, despite their overseas earnings exposure.

Making a material allocation to global companies listed outside of the UK avoids the risk that Hong Kong (or the home market of an investor not in HK) performs poorly over the longer-term by providing a broader capture of the wealth creation potential of global capitalism. This is a wise choice given Hong Kong represents only 1% of global market capitalisation*.

DIVERSIFY TO MITIGATE RISK

Diversification within developed markets (e.g. US, Germany, France, Japan etc.) is about risk reduction, not better returns. The cost of raising capital, in aggregate, by companies in one market is expected to be broadly similar across developed markets, over time. Companies in emerging markets, on the other hand, have a considerably higher cost of capital for companies, in aggregate. The flip side of the coin is that the expected return for providing capital (owning equities or bonds) is higher than that of developed markets and these risks need to be taken in a controlled manner and in moderation.

GLOBAL VS. DOMESTIC PORTFOLIOS

A piece of recent research^ reviewed the benefits of the ownership of a global portfolio rather than a domestic portfolio, using market data from 1950 to 2009. It demonstrated that broad diversification made a material difference to wealth protection on the downside over five and ten year time horizons across the majority of markets reviewed. It concluded that in the short-term, market panic and global contagion tend to result in markets falling together, but in the medium to long-term (which should concern investors more) the underlying economic growth provides protection from one economy performing poorly.

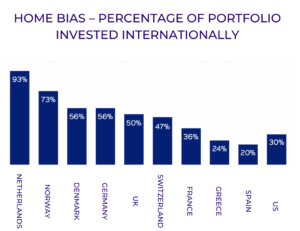

Investors are now realising that global diversification of equity market exposure is beneficial over the medium to long-term. This has driven increasing allocations by both individual and institutional investors, although this still varies considerably by country, as the above diagram illustrates.

EVIDENCE BASED INVESTING

Are you aware of how smart, global diversification of your portfolio can deliver a better relationship between risk and return and make a material difference to wealth protection over the medium to long-term?

Developing a simplified investment process for clients that guarantees global diversification is anything but easy. Some investors or investment managers will seek to provide diversification by adding multiple lines to their portfolio in the belief that sheer numbers and complexity will achieve this, when in reality they’ve created a portfolio full of repetition or inconsistencies. Our evidence – based portfolios offer investors a robust, diversified journey with various investment lines.

Interested in learning more about Evidence Based Investing?

Get in touch to learn how our team of financial planners in Hong Kong can help you create a well-diversified investment portfolio tailored to your goals, needs and risk preference.

info@pyrmontwm.com +852 2598 6777

Source:

*: (page 24) Published with permission from Dimensional Fund Advisors LP, The Matrix Book 2019.

^:(page 14) Malkiel, Burton G., (1999) A Random Walk Down Wall Street, (7th Ed) New York: W.W. Norton

Pingback : Top 5 Mistakes HNWI Make With Their Finances

Pingback : Evidence Based Investing 101: Focus On What You Can Control

Pingback : Top 5 Investment Blunders New Investors Make