Why Portfolio Diversification Still Works

At times of market stress, finding portfolio diversification might prove to be a challenge as there is often an increase in correlations, or how different asset classes interact with each other during these times. In 2020, this was particularly true as a large number of the major asset classes moved together following the impact of Covid-19. And if we look at the last two decades, many asset classes have moved upwards such as commodities, REITs, global bonds, along with others.

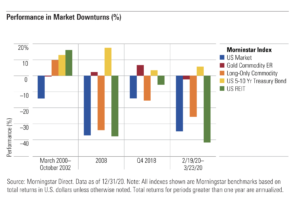

In the latest 2021 Diversification Landscape Report by Morningstar, they looked at how different asset classes performed in 2020 and how the correlations between asset classes changed. Below is a summary of the findings which proved to show that no matter how you look at it, diversification still works but it is not as simple as it might have once been.

Portfolio Diversification and How it is Impacted by Correlations

When it comes to investing, diversification has always been a recognised strategy to manage or minimise risk. However, a portfolio’s risk level isn’t just the sum of its individual components, but it’s also impacted by correlation. Correlation is a statistical measure that looks at how two securities move together, and this is measured from 1 to negative 1. The overall risk of a portfolio is reduced when asset classes with correlations below 1 are combined. However, correlation shifts and moves over time and what once might have worked, won’t work in the future. Furthermore, adding asset classes as a way of reducing volatility can actually force returns downwards. In addition, correlations between asset classes can often rise when a market crisis is taking place, and this is when you need diversification the most.

Key Asset Class Correlations in 2020

Driven by Covid-19, the market moved at a rapid pace in early 2020 and some basic diversification helped some to minimise losses. However, the equity market dropped by 34.5% from February to March 23rd 2020 although fixed-income holdings held firm. Along with this, cash and short-term treasuries also held firm with longer-term treasuries posting gains.

In 2020, a basic portfolio that had a mix of 60% stocks and 40% bonds would have lost around 13 percentage points less when compared with that of an equity-only portfolio.

During 2020, a number of major asset classes’ correlations also moved upwards although treasuries were an exception. Where cash, short-term and intermediate-term treasuries were considered, correlations stayed negative against equities and experienced a downward trend for 2020. What this shows is that there was a sharp change between risk-on and risk-off assets as investors looked to take advantage of high-quality bonds instead of stocks for the safety they offered.

Your Financial Portfolio and Asset Class Correlation – What Does it Mean For You?

On the whole, the increase in correlations across a number of major assets classes in 2020 highlights how complex building a diverse portfolio can be. Correlations are constantly changing but during periods of market volatility, they also rise. However, there is still a lot to be said about portfolio diversification. As historical evidence showed, a diverse portfolio reduced volatility and helped investors to limit losses when the market took a downturn at the start of 2020.

The Ongoing Benefits of Diversification

Furthermore, having a diverse portfolio enables investors to expand the opportunity set and enables them to take advantage of areas that offer long-term returns. Additionally, it is also important to look at asset class correlations alongside whole of market trends. Even though diversification doesn’t work across all asset classes, it is still a useful tool that can help to reduce risk and increase returns in the long-term.

Need help in building a well-diversified portfolio that’s aligned to your investment goals?

At Pyrmont Wealth Management, we can help you build (or manage) a well-diversified portfolio. Our financial planners will always look to create the optimal investment strategy to align with your risk profile and individual needs and objectives. Interested in learning more? Simply contact us at info@pyrmontwm.com +852 2598 6777

Source: Morningstar