The Power of Global Diversification

The Power of Global Equity Investing

$1.56 trillion is the amount paid to shareholders by the world’s largest 1,200 companies, including Royal Dutch Shell, Verizon, and Procter & Gamble. This massive sum is equivalent to the entire economy of Australia and bigger than the economies of Spain and Brazil. Surprisingly, the UK’s contribution is just 6%, leaving an incredible amount of wealth for individuals to access.

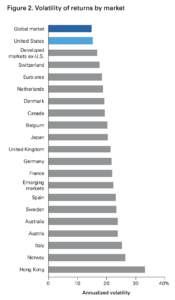

According to Vanguard’s market volatility research, diversifying your assets globally across a variety of large and small companies is a more efficient way to generate wealth than holding them all in one place.

How, then, do you properly invest in a globally diversified portfolio?

Think Beyond the Needle, Buy the Haystack!

While there are certainly some exciting investment opportunities in your home country, it’s important to recognise that these are the exceptions rather than the rule. For example in the UK for every JD Sports or London Stock Exchange Group, companies like Mothercare and Carpetright have struggled to stay afloat.

So, what’s the solution? Rather than putting all your eggs in one basket, adopting a globally diversified portfolio is far better. This approach allows you to benefit from an average growth rate that outpaces inflation and provides protection from market downturns in your home country.

‘By diversifying your investments, you’ll be able to tap into the vast potential of markets worldwide. This means more opportunities for growth and higher potential returns on your investment.

When Prediction is Never Right

Are you tired of trying to predict the next big thing in investing? The truth is no one can reliably predict which countries or companies will outperform in the long run. Take the example of Denmark, a country with the 40th biggest economy, and the USA, the largest economy in the world.Over the course of 20 years, their relative performance has been entirely unpredictable.

The randomness of this association is depicted in the chart below. Over a period of nearly 20 years, Denmark occasionally defeats the USA and vice versa.

But here’s the good news: you don’t need to predict the future to build your wealth. By investing globally, you can benefit from the growth of companies all around the world. In fact, over the past 20 years, a diversified portfolio of global companies has grown by an astounding 300%. That means every £1 you invest can turn into £4!

Sure, Hong Kong has seen some growth too, but it does not compare with the potential returns available on the global stage. If you want to build real wealth and achieve financial freedom, it’s important to think hollistically and embrace the power of global investing.

Go Global with Your Investments

If you agree that investing in international companies through a globally diversified portfolio (which naturally includes the UK) is a wise course of action, there are a few ways you may improve your chances. By putting your money in a basket containing the world’s leading companies, such as Royal Dutch Shell, Verizon, and Procter & Gamble, you’re already off to a great start.

But why stop there? Then you invest a little extra in three areas: smaller businesses (because they typically develop faster), emerging markets (because they typically grow faster), and businesses whose stock price tends to undervalue the business (because, well, you get the idea).

Of course, investing in the stock market has ups and downs. But fear not; you can balance out some of that volatility by including other types of investments like bonds in your portfolio. Bonds may provide a steady, unspectacular returns that can help take the edge off the fluctuation of share prices.

So don’t let fear hold you back from exploring the potential of global investments. Whether you’ve always invested locally or just haven’t considered diversifying your portfolio, the evidence speaks for itself: healthier returns can be found beyond our shores.