EBI Series: Resist Chasing Past Performance

One of the most common mistakes that some investors make is selecting mutual funds based on their past returns. The issue with taking this approach is the fact that past performance is not a good indicator of what could happen in the future.

Despite this, the media plays a big role when it comes to encouraging investors to look at past performance. News outlets often provide tables and commentary from the past one to three years with the aim of giving insight into the “best” funds and managers. As a result, investors believe that these returns are likely to extend into the future. Once you incorporate the role that luck plays when it comes to short-term fund performance, you soon realise why investors believe that short-term performance will continue into the future, although historical evidence shows us this rarely happens.

Evidence Shows Why We Should Resist Chasing Past Performance

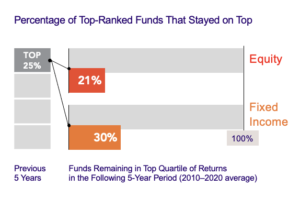

The future returns of a fund are barely influenced by past performance and those results provide little insight. In fact, the chart below confirms how the majority of US mutual funds that are positioned in the top quartile of the last five-year returns, failed to maintain their place in the top quartile rankings for the five years that followed after.

Other Factors That Drive Investors to Chase Past Performance

Past events govern much of our lives but when it comes to investment products and portfolios, there are other factors at play that underpin this approach. Marketing plays a significant role because of the way in which many of the top investment management companies implement marketing strategies that have an impact. They understand that investors, who are their potential customers, are always seeking out the latest product and portfolios that have performed exceptionally well in recent years. As a result, these companies then place an emphasis on those that have performed well and put a lot of effort into marketing them.

The way in which they operate is entirely down to them, but this is where a financial planner can help you make the right financial decisions. An honest and experienced financial planner would look at your long-term interests and ambitions with the goal of creating a long-lasting client relationship, one that’s not based on speculation and the latest investment fads.

The Importance Of Financial Planning

Over a period of ten years, the average return of a portfolio could be around 8% but this does not translate into an 8% return each year. The good years will balance out the bad years and some clients might invest in a portfolio a year before the market takes a downward turn. Therefore, giving them a figure of 8% is not going to give them confidence or comfort when this downturn takes place. It helps when investors understand that any investment that they make this year, could be worth less the following year but also to understand that it could be more, only to drop the year after that. This highlights the importance of having an understanding of risk tolerance and the losses they can afford to make as these all play a part in the financial planning process.

There is no denying that the markets work best for long-term investors. Therefore, there is no single solution when creating a portfolio. Success in investing comes through the long-term objectives of each portfolio and how each asset plays its role in the overall success of the portfolio. In the short term, some elements will perform well and others won’t. Therefore, it is important to consider the bigger picture and look at the future instead of focusing on past performance as this rarely brings success.

Want to Learn More About Evidence Based Investing?

Although past performance cannot give us insight on future performance, there are ways to better prepare yourself for the future while increasing your odds of investing success. At Pyrmont, we can do exactly that. Out team of investment advisers and financial planners can develop a LifePlan focused on your life and investment goals and develop strategies that are rooted on evidence-based investing, to help you get you to where you want to be.

Contact us today to learn how our team can can help you create a brighter financial future through evidence-based investing and our life-centred wealth management approach.

Pingback : 3 Reasons Why You Shouldn’t Panic During Market Volatility