Researching Retirement: How Inflation, Interest Rates and Market Risks Shape Your Future

Planning for retirement is never simple. The challenge is not just about building wealth over time but about making it last once regular earnings stop. A successful retirement strategy must contend with three powerful and unpredictable forces: inflation, interest rates and market performance. Each of these factors can significantly affect whether your savings stretch across a lifetime.

At Pyrmont Wealth, our approach is grounded in evidence, not speculation. Research from retirement specialists highlights just how damaging these risks can be if left unmanaged and how certain allocation strategies can offer greater resilience. In this blog, we unpack the key lessons.

Inflation: The Silent Eroder of Wealth

We all notice inflation in daily life — higher food bills, rising energy costs, and services becoming more expensive year on year. For retirees, however, inflation poses a deeper risk. If your investments are heavily tilted towards short-term, nominal fixed income, the value of your retirement income can be quickly eaten away.

Imagine drawing a steady income from bonds that are not inflation-protected. When prices rise unexpectedly, your real spending power falls. Over the course of a 30-year retirement, even modest inflation can drastically reduce what your money buys.

Evidence shows that strategies relying on inflation-linked bonds, often referred to as a liability-driven approach, can protect against this erosion. These instruments adjust with inflation, ensuring that the purchasing power of retirement income remains more stable.

Interest Rates: The Double-Edged Sword

Interest rates matter not only to borrowers but also to retirees. A sharp fall in interest rates may sound beneficial at first, since existing bond holdings can increase in value. But here’s the catch: lower rates also mean that expected returns on reinvested assets shrink. For someone planning decades of retirement income, that can create a significant funding gap.

Simulations suggest that when interest rates fall substantially, retirement portfolios focused on short-term nominal bonds face a greater probability of running out of money. By contrast, income-focused portfolios that use long-duration, inflation-linked assets are far more resilient to such shocks. They lock in a level of income that is better insulated from future rate changes.

Market Risks: Timing Matters More Than You Think

Stock markets can deliver strong long-term growth, but their volatility makes them risky companions in the early years of retirement. This is because of a phenomenon known as sequence-of-returns risk.

If poor equity returns strike just after you stop working, the combination of falling markets and ongoing withdrawals can drain a portfolio at a frightening pace. Research shows that in the worst 10% of market scenarios, retirees with high equity allocations face up to a one-in-three chance of running out of assets 20 years into retirement. That is despite originally planning for 30 years of income.

In contrast, more balanced, income-focused portfolios, with a smaller equity landing point, dramatically reduce this risk. Even when markets stumble early, the chance of exhausting assets is far lower. And if portfolios do fail, they tend to do so much later in retirement, rather than within the first two decades.

Wealth-Focused vs Income-Focused: What’s the Difference?

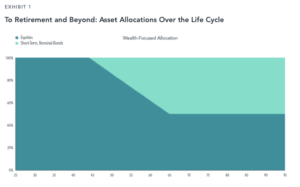

Traditional retirement planning often leans towards a wealth-focused allocation, aiming to maximise portfolio growth by maintaining a higher proportion of equities. While this approach can generate strong returns in favourable conditions, it leaves retirees vulnerable in tougher economic climates.

An income-focused allocation, by contrast, tilts towards stability. It incorporates inflation-protected and liability-driven assets, alongside a more moderate equity allocation. The aim is not to chase maximum wealth but to support more reliable, predictable retirement income.

Evidence suggests that while no approach is bulletproof, income-focused strategies deliver stronger downside protection across inflation shocks, interest rate changes and market downturns.

Why This Matters for Real People

It’s tempting to think of retirement planning as a purely technical exercise, full of percentages and projections. In reality, the stakes are deeply human. Many people are forced into retirement earlier than expected due to health issues, redundancy, or other life events. Entering retirement during a turbulent market, or just as inflation spikes, can have life-altering consequences if the portfolio is not prepared.

That is why risk management should not be viewed as a sacrifice of returns, but as an enabler of confidence. Knowing that your income is structured to withstand adverse conditions provides peace of mind. It also helps retirees stay the course in good times, rather than panicking when headlines turn negative.

The Pyrmont Wealth Perspective

At Pyrmont Wealth, we believe in evidence-based investing. That means basing decisions on robust research and long-term data, not speculation about what might happen next week or next quarter. When it comes to retirement, the evidence is clear:

-

Inflation protection matters. Without it, even modest price increases can erode your lifestyle.

-

Interest rates can surprise. Income-focused strategies help reduce the uncertainty of future returns.

-

Market timing is risky. Concentrated equity exposure just as you retire can increase the chance of running out of money too soon.

-

Diversification is your ally. A balanced approach allows for resilience in the face of uncertainty.

Retirement is not about predicting the future with confidence. It is about preparing for uncertainty with discipline and evidence.

Final Thoughts

Retirement planning will always involve risk. But research shows that the way we allocate assets between equities, nominal bonds and inflation-protected securities has a profound impact on the probability of sustaining income over a lifetime.

The lesson is simple yet powerful: rather than stretching for maximum returns, retirees are often better served by strategies that prioritise reliable income and robust risk management.

At Pyrmont Wealth, our goal is to help clients build retirement portfolios that withstand inflation, interest rate shifts and market volatility, so they can focus on enjoying the years ahead with greater peace of mind.

Ready to talk about your retirement plan?

We’d be delighted to help you explore how an evidence-based, income-focused approach could support your goals. Contact us today to start the conversation.

Source: Dimensional, Researching Retirement: The Impact of Inflation, Interest Rates, and Market Risks