Don’t Try To Outguess The Market

Have you ever tried to time or outguess the market to get a promising investment return?

Attempting to outguess the market can prove challenging and almost impossible with most successes being attributed to just luck. The reality is that the market’s pricing power often works against mutual fund managers who try to succeed via stock picking or market timing.

WHAT HISTORICAL EVIDENCE TELLS US

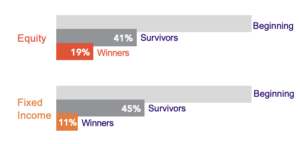

In fact, evidence shows us that only 19% of US equity mutual funds and 11% of US fixed income mutual funds have survived and performed better than their benchmarks throughout the last 20 years!

Despite this, many fund managers still believe they can identify “mispriced” securities and convert that knowledge into higher returns. But fair market pricing works against such efforts, as indicated by the large proportion of mutual funds that have underperformed their benchmarks.

In this chart, the light gray bars represent the number of US-domiciled equity and fixed income funds in operation during the past 20 years. These funds compose the beginning universe of that period. The dark gray areas show the percentage of equity and fixed income funds that survived the 20-year period. The red and orange bars show the smaller percentage of equity and fixed income funds that survived and outperformed their respective benchmarks during the period.

There are plenty more examples of this across all investment indexes that show us that over both short and long-time horizons, the deck is stacked against mutual funds that attempt to outguess the market.

THE RANDOM NATURE OF OUTPERFORMANCE

Most recently, the Wall Street Journal published an article, ‘The Darts Beat the Experts in Investing,’ which illustrated the random nature of outperformance:

“It’s the simple truth the investing industry and financial media cannot afford to acknowledge: most money managers would produce similar or better returns if they chose their stocks at random.” The reality is that investment outperformance is random and oftentimes money managers’ could be more successful if they simply picked stocks at random.

THE PRINCIPAL-AGENT PROBLEM

Evidence also shows us that human behaviour also influences someone’s investment plans and overall experience. This idea is supported by ‘The Principal-Agent Problem.’

A real-life example of this would be a person (who is known as the principal), requesting the services of a plumber (the agent) to identify a leak problem and rectify it. The plumber would have a detailed understanding of ‘plumbing’ and so, they can identify the issue without being challenged by the principal and they could also charge whatever they wish.

If we bring it back to investing, this kind of thinking can also shape our idea of what constitutes “successful investing”. Take someone who is new to investing, they will understand that they or their fund manager will need to do something extraordinary (relative to the rest of the market) to find investing success. This approach is consistently adopted by fund managers and that is mainly down to the fact that it helps them to increase sales of the products that they sell and therefore, receive earnings from. What this means is the entire idea or belief that supports ‘underperformance’ remains in place.

OTHER FACTORS AT PLAY

Although past performance provides no real insight into the investment returns that a fund will provide in the future, it is natural instinct to look at past events in order to gain an idea of the future. However, in the case of investments, this isn’t the only factor behind thinking this way. Many big investment management companies believe that their marketing plays a role too. They believe that investors will be looking for products and portfolios that have performed well in past years and so, these are the ones that they will focus on promoting.

In conclusion, attempting to outguess the market based on the past is once again going to result in a hit-or-miss approach. Past performance has no bearing on future returns, so whether it’s outguessing the market or being seduced by marketing, it’s more important to focus on diversification as a way of increasing the chances of success when investing.

A BETTER INVESTMENT EXPERIENCE

Although the future cannot be predicted, there are ways to better prepare yourself for it while increasing your odds of investing success. At Pyrmont, we can do exactly that. Out team of investment advisers and financial planners can develop a LifePlan focused on your life and investment goals and develop strategies that are rooted on evidence-based investing, to help you get you to where you want to be.

Contact us today to learn how our team can can help you create a brighter financial future through evidence-based investing and our life-centred wealth management approach.

Pingback : Evidence Based Investing 101: Focus On What You Can Control