EBI SERIES: Embrace Market Pricing

The stock market is an efficient, information processing machine. Every day, the world equity markets process billions of pounds worth of trades between buyers and sellers- and the real time information they bring, helps set prices. Free markets set prices for financial assets based on supply and demand which works effectively, as all the information that’s available across the globe is already absorbed into the markets’ prices.

The Efficient Markets Hypothesis

The Efficient Markets Hypothesis (EMH) states that a company’s shares are priced based on all the relevant information available to the public about that stock. As a result, the company’s share price is given based on the best estimate available at that time.

However, investors who are looking for anomalies that enable them to take advantage of under-priced stocks, will need to remember that it is rare for securities to be mispriced. If they are mispriced, this is likely to be short-lived, and often lead to nothing after all trading costs are deducted. This important principle of Evidence Based Investing indicates that the markets work well, regardless of what professional fund managers believe.

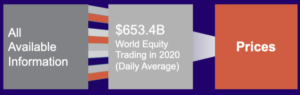

Exhibit 1*

The Zero-Sum Game

Too often, investors will not take time to think about what they are doing and the investment “game” that they are playing. So, consider two investors that own the whole of the market. The one investor chooses to pick and own all of the companies that performed better than the market. By definition, the other investor is then left with all of the stocks that did not perform and therefore, were beaten by the market. So, the investor that experiences losses will be the one to fund the gains made by the other investor, this is known as the zero-sum game.

Evidence Based Investing

It’s important to remember that investing requires the correct approach. One that’s focused on historical data and making investment decisions based on evidence rather than emotion. An Evidence Based Investing approach helps to take much of the emotion out of investing with its sole aim being to deliver investors with the highest probability of a successful investment outcome. However, when it comes to investing, there is never a guarantee that gains will be made, and this is because many uncertainties surround the market. What it does offer is for investors to make better decisions based on rational thinking, helping to avoid the problems that come with common mistakes that can prove to be costly. This is often true when it comes to chasing markets and those managers who are looking for returns that are market beating. Many then find that they become consumed by the latest investment trends or fads as well as marketing stories and press coverage. This means that losses are often likely, and any potential gains will be short-lived.

What about professional fund managers?

Should professional fund managers look as though they have the scope to beat the markets in a consistent way over a long-term period and in a way that is identifiable, then this could highlight that adopting a judgemental active management approach (i.e. market and price forecasting) is likely to be a strategy that is feasible. If this is not the case, then a strategy of purchasing and holding, also known as a systematic approach to investing, could be the preferred option. This is down to the fact that this would give investors the rewards they are seeking after they have taken certain investment risks.

The market has a huge amount of power, especially in a way that works against mutual fund managers who attempt to outperform via market timing or stock picking. The guessing game, while not impossible, is challenging and with that comes risk. Investing systematically or through a judgemental active management approach both come with risks but in the long-term it is likely to perform better as historical evidence shows us.

At Pyrmont Wealth Management, we believe that following an Evidence Based Investing approach that will often lead to a better investment experience. We will always be guided by the academic research and historical evidence available and will ensure our approach is always in our clients’ best interests.

Interested in learning more about Evidence Based Investing? Get in touch to learn how our team of financial planners can help you by creating a bespoke evidence-based investment strategy tailored to your needs and interests.

info@pyrmontwm.com +852 2598 6777

In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

Pingback : Evidence Based Investing 101: Focus On What You Can Control