Can I Do Better Than Just Buying Index Funds?

Index funds have grown enormously popular over the past few decades, and for good reason. They are low cost, broadly diversified, and simple to understand. For many investors, they’ve been a welcome antidote to expensive, underperforming active funds.

But at Pyrmont Wealth, we often hear a question from thoughtful investors: “If index funds are good, is there anything better?”

The answer is yes because index funds, while a step forward, come with built-in limitations. By focusing on simply matching benchmarks rather than seeking the best available returns, they can leave value on the table. Evidence-based investing, which we practice at Pyrmont Wealth, takes the next logical step forward.

Why Index Funds Aren’t Perfect

Index funds are designed to track a benchmark as closely as possible. If a benchmark includes 500 companies, the fund will try to replicate that list exactly. When the index changes, which may happen quarterly, semi-annually, or once a year, the fund must also adjust its holdings.

This rigid structure creates challenges.

Imagine shopping for roses on Valentine’s Day. Everyone suddenly wants the same thing at the same time, driving up the price. Index funds face a similar problem. When a company is added to a benchmark, every index fund tracking that benchmark has to buy its stock, often on the same day. That sudden wave of buying can push the price up, forcing index fund investors to pay more than they otherwise might.

Likewise, when a company is removed from an index, funds must sell their shares, often when prices are under pressure. This “buy high, sell low” dynamic is not ideal for long-term investors.

The Impact of Forced Trading

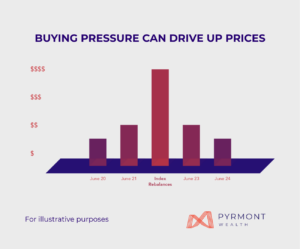

The chart below illustrates this concept:

Illustrative Impact of Index Rebalances

-

Prices are lowest before and after the rebalance (June 20 and June 24).

-

Prices rise leading into June 21, then peak at June 22 when the rebalance occurs.

-

Prices fall back down in the following days.

This visual highlights how concentrated buying and selling during index changes can temporarily distort prices. If you are investing through a traditional index fund, you are caught up in that wave whether it benefits you or not.

Evidence-Based Investing: A Smarter Alternative

Instead of rigidly mirroring benchmarks, evidence-based investing applies a more flexible, research-driven approach. The philosophy, pioneered by firms like Dimensional and followed by Pyrmont Wealth, draws on decades of academic work in financial economics.

Key principles include:

-

Broad diversification without unnecessary constraints

Evidence-based funds hold thousands of stocks across markets, but without being forced to follow index rules. This allows them to avoid crowded trades around rebalances. -

Systematic tilts toward drivers of higher expected returns

Academic research has shown that certain factors such as company size, relative price (value vs. growth), and profitability are associated with higher expected returns over time. Evidence-based strategies systematically tilt portfolios toward these drivers in a disciplined way. -

Flexibility in trading

Unlike index funds that must trade on specific days, evidence-based managers can be patient. They may choose to buy or sell when prices are more favorable, avoiding the spikes and troughs caused by forced index rebalances. -

Low costs and efficiency

Like index funds, evidence-based strategies keep expenses low and aim for efficiency. But they combine those benefits with smarter implementation that can improve outcomes.

The Results Speak for Themselves

Over the long run, this flexible, research-driven approach has the potential to capture higher expected returns than traditional index funds, while still keeping costs low and diversification high.

-

Less money left on the table: By avoiding forced trades, evidence-based investors can buy at more favorable prices and avoid overpaying.

-

Exposure to proven drivers of return: Instead of just holding “the market,” evidence-based strategies tilt toward areas with strong academic support, like value and profitability.

-

Peace of mind through discipline: By removing the pressure to chase market fads or time rebalances, evidence-based investing helps investors stay the course.

Why This Matters To You

For investors in Hong Kong and globally, the message is clear: while index funds have been a powerful innovation, they are not the final word in smart investing.

At Pyrmont Wealth, we believe in going beyond benchmarks. By applying the principles of evidence-based investing, we help our clients capture market returns more effectively without unnecessary constraints. It’s an approach rooted in data, not speculation, and designed to serve your long-term financial goals.

In other words: you can do better than just buying index funds.

Conclusion

Index funds deserve credit for democratizing investing, making diversified portfolios accessible to millions. But their rigidity, especially around benchmark rebalances, means investors can sometimes pay more and earn less than they should.

Evidence-based investing provides the next evolution. By combining academic insight with practical flexibility, it offers a smarter path for disciplined, long-term investors.

At Pyrmont Wealth, we are proud to bring this approach to our clients in Hong Kong and beyond. Our mission is to help you invest with confidence, knowing your wealth is guided by principles that stand the test of time.

Book a FREE initial consultation to learn more.